How to Avoid Becoming a Victim of Fraudsters, Scammers, and Payday Loans This Holiday Season

As the holiday season approaches along with snow, gifts, carols, and a sense of joy in the air, so too unfortunately do fraud, scams, and payday loans, often targeting the most vulnerable segments of the population, such as seniors.

Many of these scams are conducted online or over the phone, but some can even involve face-to-face communication.

Types of Scams

Here are some examples of the types of common scams that people, including seniors in particular, may be targeted by:

Payday loans:

While payday loans are technically legal, unlike many things listed here, they often use deceptive techniques to extort money from whoever signs up for one. Payday loans are often filled with dangerous hidden fees that have a lasting impact on your wallet and credit score.

Before signing up for anything, read the fine print and take the information home to understand the true costs in fees, payments, and late fines. You should report deceptive telemarketing to the Canadian Anti-Fraud Centre by calling 1-888-495-8501 or online at https://antifraudcentre-centreantifraude.ca.

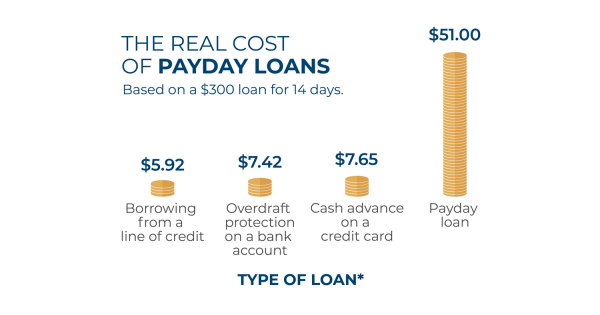

Here’s a look at the real cost of payday loans compared to other methods of borrowing money:

Through methods such as these, payday loans use costly hidden fees to quickly deplete your financial resources and credit score.

Grandparent scam:

In this scam, the caller pretends to be an elderly person’s grandchild and claims to be in a dire situation, such as getting in an accident in a rental car or landing in jail in a foreign country, requesting money to help them get out of whatever circumstance they are supposedly caught in. While many types of scams could potentially target anyone, this one specifically targets seniors, which makes it especially troublesome. One way to stop these scammers is to ask them personal questions that only your actual grandchild would know the answer to.

Charity scams:

Charitable giving increases during the holidays, which is a great thing—however, this also means that scammers posing as fake “charities” also increases at this time of year. These donations to these fake “charities” are often solicited online or over the phone, but they can sometimes even involve door-to-door campaigns.

Package delivery scams:

Since this is the season for giving and receiving, it’s also the season for package delivery scams. People both sending out and receiving packages have been victimized by these scams, in which a buyer makes an order online or over the phone from the scammer and receives nothing, or conversely, a seller sends a package to a fraudulent buyer who takes it but does not pay them for it. Collecting personal information can also be the goal of these scams.

Gift card scams:

Many people love giving gift cards for the holiday season—they give the recipient the freedom of choosing what they want to get. But unfortunately, this also means the opportunity for fraudsters to sell fake gift cards.

Travel scams:

With many people flying to warmer climates for the holidays, travel scams are something to especially watch out for this time of year. Fake booking sites and email offers are a common way through which these scams are carried out.

Online shopping scams:

These often involve fraudulent websites selling items or services at prices that seem too good to be true. When buying gifts for the holidays, be aware of this, and only buy from websites that strongly appear to be legitimate. If you are unsure, it is often a good idea to do an internet search about the vendor who you are considering buying from to learn more about them.

Phishing scams:

These are another type of scam that increases during the holiday season. Phishing is when you are tricked into revealing personal information by someone pretending to be a representative of a legitimate business or organization. This can often happen with people pretending to be your internet provider and asking for your password or other personal information—always double check that the sender of any email that claims to be from your internet provider is legitimate. To learn more about phishing threats, please check out this article by Skyline Wealth.

How to Detect Scams

How can you tell if something is a scam or if it’s legitimate? There are a few ways. Often, doing an internet search about a supposed company or organization can help you verify whether or not it’s legitimate. Anything that has very few results is suspect. Google, Wikipedia, and other such sources can be great ways of verifying whether something is actually for real.

Checking Google Reviews to see the number of reviews can be helpful, for instance, as anything that is fraudulent often has no reviews, few reviews, or fake-looking reviews (i.e., only reviews with a rating but no text, reviews that look like they were written by a bot, or reviews with nonsensical text). Read through the reviews to see if they look like they were written by a real human being or not.

Discounts or deals that seem too good to be true are also a major red flag—as the old saying goes, if something seems too good to be true, it probably is.

Grammatical errors, spelling errors, formatting errors, or a generally unprofessional design can be huge red flags when looking at a website or an email message. Fraudulent communications are more likely to have these types of issues (although, admittedly, there are some legitimate businesses that may occasionally have these issues in their websites and communications as well—for instance, certain independently owned local shops or restaurants that don’t have a large base of staff).

Asking you for personal or sensitive information over email or text is another red flag. Additionally, if a message conveys a sense of urgency, as if you need to act immediately, that should be seen as suspect, as most companies typically send notice before taking actions such as terminating your account.

A lack of a privacy policy on a website is a telltale sign of a fraudulent site. The same is true of the lack of a physical address or phone number listed for a company on its website, especially if it is the sort of company that should have a physical address by nature of the type of business it is.

Any unsolicited email that asks you to download an app or click on a link should be viewed with suspicion. Strange attachments or hyperlinks, including odd file types or file names, should also be regarded as potentially malicious.

A message from a legitimate organization, such as your bank or a company you have an account with, would usually include your account name or number or some other identifying information that only they would know. If it contains no such information, you should regard it as likely to be suspicious.

Some steps you can take to protect yourself include frequently updating your passwords, using spam filters in your email inbox (although these may sometimes filter out legitimate emails as well), and changing your browser settings to only open trusted websites.

Learn More

Want to learn more? Check out some of these helpful links:

https://cba.ca/grandparent-scam?l=en-us

https://www.antifraudcentre-centreantifraude.ca/features-vedette/2021/11/holiday-fetes-eng.htm